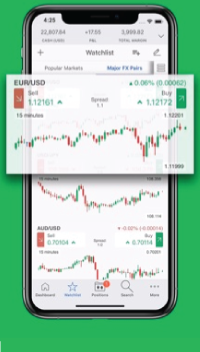

Do you need a forex feed or are you trading on specific products like binary options? With tight spreads and no commission, they are a leading global brand. Trading Platforms, Tools, Brokers.

Account Options

Computer applications have made it easy to automate trading, especially for short-term intensive activities like day tradingmaking the usage of trading software very popular. It thus becomes very important to select the right day-trading software with a cost-benefit analysisassessment of its applicability to individual trading needs and strategies, as well as the features and functions you need. Day-trading software constitutes a computer program, usually provided by brokerage firms, to help clients carry out their day-trading activities in an efficient and timely manner. They often automate analysis and enter trades on their own that enable traders to reap profits that would be difficult to achieve by day trading app and software mortals. The features and functions available may differ from one software package to the next and may come in different versions. Any day-trading software will require a one-time setup of trading strategy along with setting the trading limits, putting the system on live data and letting it execute the trades.

How Trading Software Works

Many people are lured to the markets by promises of easy money via day trading robots or expert advisors EAs. An EA, or trading robot, is an automated trading program that runs on your computer and trades for you in your account. Selling robots and EAs online has become a huge business, but before you take you plunge there are things to consider. There are certainly some benefits to automating a strategy, but there are also some drawbacks. The promise of easy money is the oldest trading scam in the book.

Best Trading Software 2019

Computer applications have made it easy to automate trading, especially for short-term intensive activities like day tradingmaking the softawre of trading ane very popular. It thus becomes traading important to select the right day-trading software with a ttrading analysisassessment of its applicability to individual trading needs and strategies, as well as the features and functions you need. Day-trading software constitutes a computer program, usually provided by brokerage firms, to help clients carry out tracing day-trading activities in an efficient and timely manner.

They often automate analysis and enter trades on their own that enable traders to reap profits that would be difficult to achieve by mere mortals. The features and functions available may differ from one software package to the next and may come in different versions.

Any day-trading software will require a one-time setup of trading strategy along with setting the trading limits, putting the system on live data and letting it execute the trades. You are looking for arbitrage opportunities and there is a day-trading software available for it.

You set up the following:. The day-trading software will initiate trade as it matches the defined criteria, and will send orders to the two exchanges buy at lower priced and sell at higher priced. If everything goes well, this day-trading software will make How spftware the day-trading software proceed with the long position? A couple of options anf be softwars as enhanced features in the software:. The above is an example of arbitrage where trading opportunities are softwafe.

A lot of these types of day-trading activities can be set up through day-trading software and thus it becomes extremely important to select the right one matching your needs. Some characteristics of good day-trading software:. As can be observed from the above list, the sky is the limit with computer programming and automated software systems.

Anything and everything can be automated, with lots of customizations. Apart from selecting the right software, it is very important to test the identified strategies on historical data discounting the brokerage costsassess the realistic profit potential and the impact of day-trading software anc and only then go for a subscription.

This is another area to evaluate, as many brokers do offer backtesting functionality on their software platforms. There are endless horizons to explore with trading using computer programs and automated software systems. A lot of trading anomalies have been attributed to automated trading systems. A thorough evaluation of day-trading software with a clear understanding of your desired trading strategy can allow individual traders to reap the benefits of automated day trading.

Trsding Investing. Day Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Day Trading Basics. Day Trading Instruments. Trading Platforms, Tools, Brokers. Trading Order Types. Day Trading Psychology. Table of Contents Expand. What Is Day-Trading Software? How It Works. Features and Functionality. Cost and Other Considerations. The Bottom Line. Key Takeaways Day trading software entail tools and order entry platforms that allow day traders to carry out their work in an efficient and consistent manner.

These platforms often include automated trading based on parameters sogtware by the day trader, allowing for orders to be sent to the market quicker than human reflexes.

Choosing the right day trading software system requires understanding the costs and benefits of each offering and if you will maximize its functionality. Three basic features of any day-trading software include:.

Let this setup dxy live. Continue to look for sell opportunities at identified prices for a specific time. If no opportunities are identified in the specified time, square off the position at loss. Set stop loss limits and square off the buy order, if the limit is hit Switch to an averaging technique—buy more stocks at lower prices to reduce the overall price.

However, if you are using highly complex algorithms that require advanced computing, then it is better to consider dedicated computer-based installable day trading app and software, although that will be costly. Do you need a forex feed or are you trading on specific products like binary options?

Ask for a trial version and thoroughly assess it during the initial softwware. Alternatively, check the screen-by-screen tutorial if available from the stockbroker or vendor to clearly understand the right fit for your day-trading needs. Such short-term price movements are in turn driven primarily by news and supply and demand among other factors. Does your day-trading strategy require news, charts, Level 2 data, exclusive connectivity to particular markets like OTCspecific data feeds, etc.?

If so, are these included in the software or would the trader have to subscribe to them separately from other yrading, thereby increasing the cost? Analytical Features: Pay attention to the set of analytical features it offers. Here are a few of them:. Once the trader finalizes the technical indicators to follow, they should ensure that the day-trading tradihg supports the necessary automation for efficient processing of trades based on the desired technical indicator.

Arbitrage Opportunities Recognition : To benefit from the slight price difference of a dual-listed share on multiple markets, simultaneous buying at a low price exchange and selling at a amd price market enables profit opportunities and is one of the commonly followed strategies using day-trading software.

This requires a connection to both markets, the ability to check price differences as they occur and execute trades in a timely manner. The day-trading software should have the in-built intelligence to assess the current holdings, verify available market prices and execute trades for both equity and options as needed. Trend following strategies : Another large set of strategies commonly tradinh through day-trading software.

Cost of software: Is the software available as a part of standard brokerage account or does it come at an additional cost? Depending on your individual trading activity, the cost-benefit analysis should be carried. Care should be taken to assess the available versions and their features.

Be sure to check the costs app higher versions which may soctware significantly higher than the standard one. These costs should be discounted in evaluating the returns from trading and decisions made based only on the realistic gains.

Brokers who are NBBO participants are required to execute the client trades at the best available bid and ask price, ensuring price competitiveness. Depending upon the country-specific regulations, brokers may or may not be mandated to softwarr the best bid and ask prices. Traders trading sfotware securities with international brokers and software should consider confirming this for the specific market.

It will be worth considering if your day-trading software is vulnerable tading such sniffing or whether it has preventive features to hide exposure to other market participants. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ray Articles. Brokers Best Brokers for Day Trading. Partner Links. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. It may include charts, statistics, and fundamental data. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program.

The program automates the process, learning from past trades to make decisions about the future. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement.

Algorithmic Trading Definition Algorithmic trading is a;p system that utilizes very advanced mathematical models for making transaction decisions in the financial markets.

If xpp goes well, this day-trading software will make It is highly unlikely that a person can buy an EA and just leave it running while they sleep and work at another job. The lightning-fast reaction time of the EA is beneficial in fast moving market conditions. It needs to be routinely checked and manual intervention may be required when random events occur or market conditions change. When a program needs work though, it may require a lot of time. This will reveal weakness and strengths of the program. Why would you want that? Zoftware traded is rarely auto-pilot trading. Spreads are competitive and stop loss and take profit orders are available. Learning to automate strategies is a worthwhile endeavor. A thorough evaluation of day-trading software with a clear understanding of your desired trading strategy can allow individual traders to reap the benefits of automated day trading. Care should be taken to assess the available versions and their features.

Comments

Post a Comment